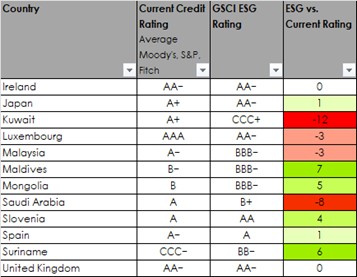

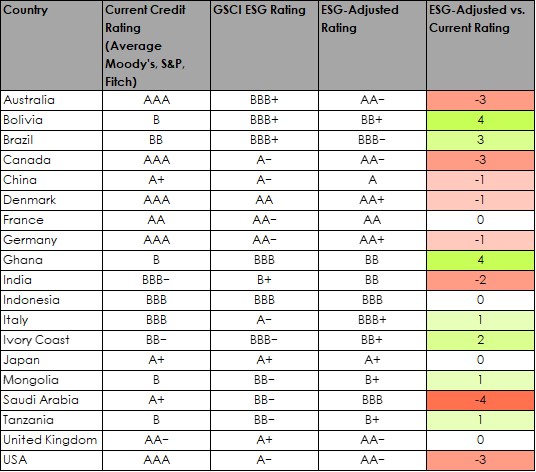

Sovereign bond ratings are heavily influenced by the large rating providers—Moody's, S&P, and Fitch. However, these conventional ratings fail to adequately account for environmental, social, and governance (ESG) risks that increasingly determine long-term creditworthiness. The comparison of ESG-adjusted sovereign bond ratings based on the Global Sustainable Competitiveness Index (GSCI) versus conventional ratings reveals significant disconnects between sustainability risks and perceived credit quality. For a comprehensive comparison of ESG sovereign bond ratings vs. conventional ratings, see our detailed analysis.

The Fundamental Disconnect

Traditional sovereign bond ratings focus heavily on short-term fiscal metrics, GDP levels, and immediate debt servicing capacity. While these factors matter, they ignore fundamental sustainability risks that will increasingly impact countries' economic performance and creditworthiness over time.

Key Differences Between ESG and Conventional Ratings

- ESG-adjusted ratings and conventional ratings show significant differences in country risk assessment

- Countries highly reliant on natural resource exploitation would be rated lower under sustainability-adjusted frameworks

- Lesser developed countries with healthy fundamentals—biodiversity, education, governance—would receive higher ESG-adjusted ratings

- Conventional sovereign bond ratings do not sufficiently reflect non-tangible risks and opportunities associated with specific nation-economies

- Traditional ratings show high correlation to GDP/capita levels, systematically rating poor countries lower and charging them higher interest rates

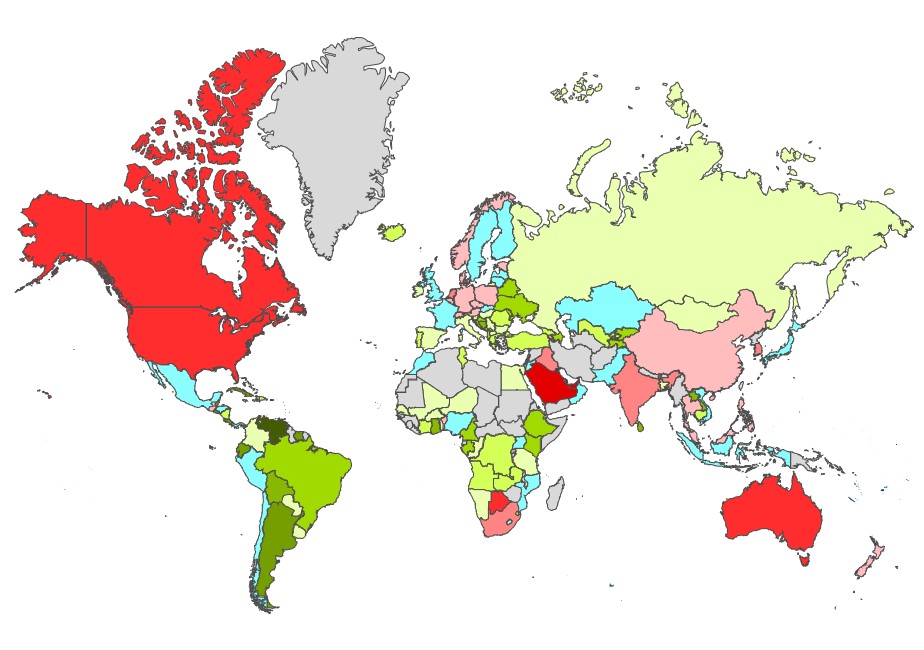

ESG vs Conventional Credit Ratings: Global Comparison

The comparison reveals distinctive patterns across regions. Countries whose current wealth depends significantly on non-renewable resource extraction—particularly oil-rich nations in the Middle East—receive lower ESG-adjusted ratings, reflecting the long-term risks of declining fossil fuel demand and revenue collapse.

Regional Patterns in Rating Divergence

Oil-Dependent Economies: Overrated by Conventional Metrics

Middle Eastern oil exporters typically receive favorable conventional credit ratings based on current fiscal strength and low debt levels. However, ESG-adjusted ratings recognize that dependence on fossil fuel revenues creates massive transition risks. As global oil demand peaks and declines, these countries face potential revenue collapse unless they successfully diversify their economies—a challenging transformation requiring strong governance capacity and rapid adaptation.

Eastern Europe and South America: Underrated Potential

Eastern European countries and South American nations (except Chile) generally receive better ESG-adjusted ratings than conventional assessments. These countries often possess strong fundamentals—renewable energy potential, agricultural capacity, biodiversity, and improving education systems—that conventional ratings undervalue. While fiscal metrics may appear weak, underlying natural capital and human capital development create long-term economic resilience.

Sub-Saharan Africa: Hidden Strengths

Several African countries, particularly in sub-Saharan tropical regions, show higher ESG-adjusted credit ratings than conventional assessments. These nations often possess significant natural capital—forests, biodiversity, renewable resources—and young, growing populations. While governance challenges and limited current GDP constrain conventional ratings, ESG frameworks recognize potential for sustainable development if properly managed.

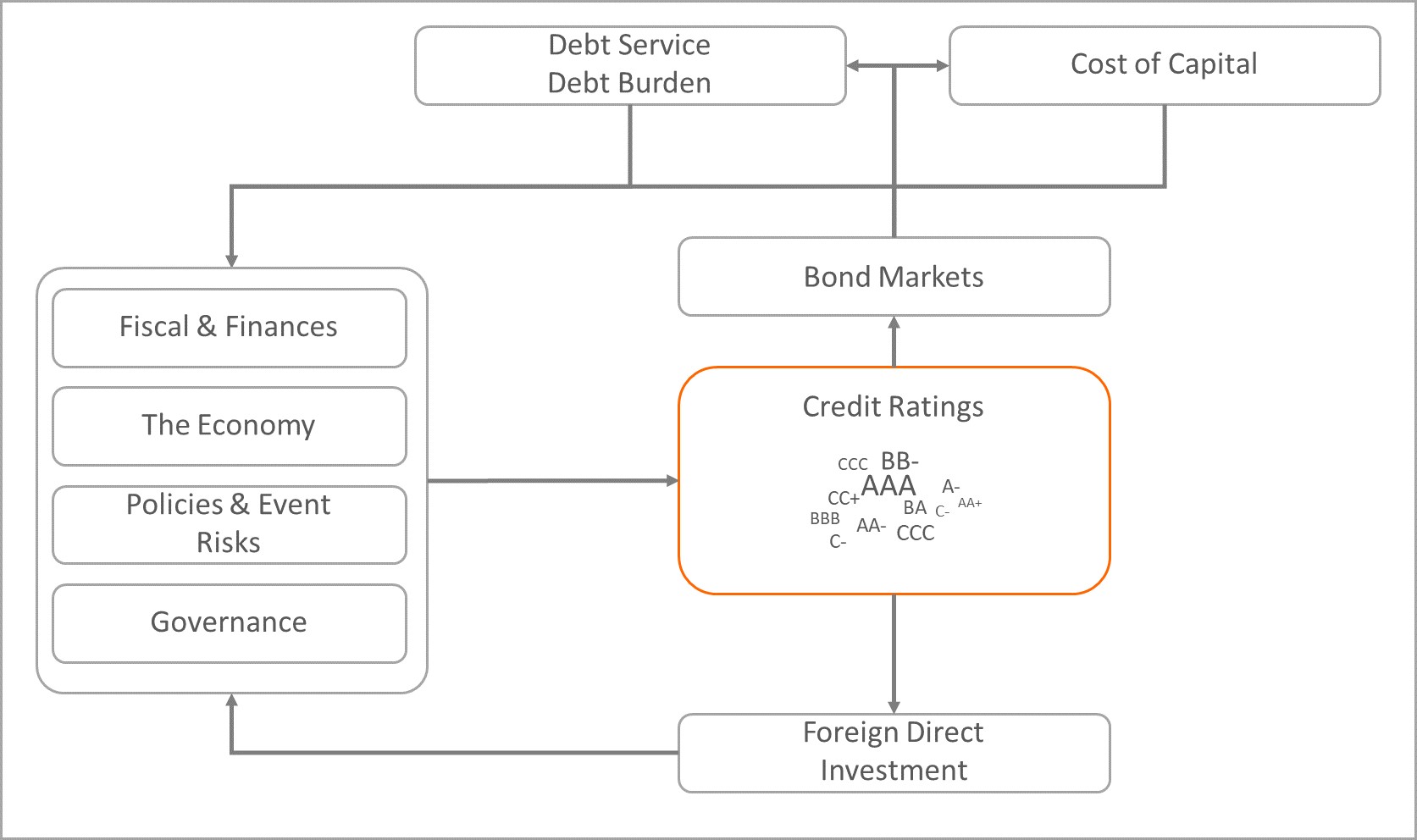

The Negative Circularity Problem

Conventional sovereign bond ratings create a problematic circularity that can trap countries in cycles of poor creditworthiness:

Credit rating circle: bad credit rating leads to higher capital costs, leads to bad credit rating

The Credit Rating Trap

- Low Rating: Country receives poor credit rating based primarily on low GDP/capita and weak current fiscal metrics

- High Borrowing Costs: Poor rating forces country to pay higher interest rates on sovereign debt

- Debt Service Burden: Higher interest payments consume larger portions of government budget, reducing funds available for development investments

- Constrained Development: Limited investment capacity constrains education, infrastructure, and economic diversification

- Perpetual Low Rating: Inability to invest in development perpetuates low GDP and weak fiscal metrics, maintaining poor credit rating

This circularity punishes countries with development potential while rewarding those with current wealth—regardless of whether that wealth rests on sustainable or unsustainable foundations. ESG-adjusted ratings help break this cycle by recognizing underlying strengths and rewarding sustainable development trajectories.

Why ESG Factors Matter for Sovereign Credit

ESG factors directly impact countries' long-term ability to service debt and maintain economic growth:

Environmental Risks

- Climate Change Impacts: Countries vulnerable to climate disruption face agricultural losses, infrastructure damage, and forced migration that strain fiscal capacity

- Resource Depletion: Economies dependent on depleting natural resources face inevitable revenue decline

- Energy Transition: Fossil fuel exporters face structural economic challenges as global energy systems transition to renewables

Social Factors

- Education and Human Capital: Countries investing in education build productive workforces that generate sustainable economic growth

- Social Cohesion: High social capital reduces conflict risks and enables long-term planning

- Healthcare Access: Healthy populations are more productive and generate higher tax revenues

Governance Quality

- Institutional Effectiveness: Strong governance enables effective policy implementation and attracts investment

- Corruption Control: Transparent institutions reduce economic inefficiencies and capital flight

- Rule of Law: Predictable legal frameworks enable long-term investment and economic planning

Progress and Remaining Gaps

While the financial sector has made significant progress integrating ESG considerations—with rating agencies beginning to incorporate sustainability factors—substantial gaps remain. ESG country credit ratings based on the Global Sustainable Competitiveness Index demonstrate that conventional sovereign bond ratings still underweight critical long-term risks and opportunities:

- Fossil fuel transition risks remain inadequately priced in ratings of resource-dependent economies

- Natural capital depletion and climate vulnerability receive insufficient weight

- Education and human capital development are undervalued relative to current GDP levels

- Governance quality receives limited consideration despite its fundamental importance for long-term economic performance

- The GDP/capita bias systematically disadvantages developing countries with strong fundamentals

Implications for Investors and Policymakers

For Investors

Investors relying solely on conventional credit ratings may mispriced sovereign debt risk. Countries with favorable conventional ratings but poor ESG fundamentals face long-term downgrades as sustainability risks materialize. Conversely, countries with lower conventional ratings but strong ESG metrics may offer better risk-adjusted returns as their fundamentals translate into economic growth.

ESG-adjusted sovereign bond analysis provides a more complete risk assessment, incorporating factors that will increasingly determine creditworthiness as climate change accelerates, energy systems transition, and sustainable development becomes economically essential.

For Policymakers

Countries seeking to improve credit ratings should focus not just on short-term fiscal metrics but on strengthening ESG fundamentals that determine long-term economic resilience:

- Diversify away from fossil fuel dependency before transition risks materialize in conventional ratings

- Invest in education and human capital to build sustainable economic capacity

- Strengthen governance institutions to improve policy effectiveness and attract investment

- Protect natural capital that provides long-term economic value

- Build social cohesion and inclusive development that creates stable foundations for growth

As global capital markets increasingly incorporate ESG factors, countries with strong sustainability fundamentals will access cheaper capital, creating virtuous cycles of development. Those ignoring ESG risks will face rising borrowing costs as their vulnerabilities become apparent.

ESG-adjusted sovereign bond ratings provide a more accurate assessment of long-term creditworthiness

By incorporating environmental risks, social fundamentals, and governance quality, ESG frameworks recognize that sustainable development creates the most reliable foundation for debt servicing capacity. As sustainability factors increasingly impact economic performance, ESG-adjusted ratings will prove more predictive than conventional assessments focused narrowly on current fiscal metrics.

Explore Further

For detailed ESG country ratings and sustainability metrics, explore the Global Sustainable Competitiveness Index or download the full GSCI 2024 Report for comprehensive analysis and country-specific data.