ESG Credit Rating & Sovereign Bonds

Conventional credit ratings miss critical ESG risks. See how sustainability-adjusted ratings reveal the true creditworthiness of 192 countries.

Some countries are overvalued based on over-simplified financial indicators

Emerging economies are regularly under-estimated

Significant rating gaps across 192 countries

ESG country ratings: a better analysis of investor risks & opportunities

Sovereign risk ratings –commonly referred to as credit rating – determine the level of interest a country has to pay for government loans and credits. It is therefore a very important parameter for every economy: it defines the costs of capital for new investments, whatever the nature of those investment may be. Credit ratings also affect investment decisions.

Sovereign risk ratings are calculated by a number of rating agencies, most notable (and defining) by the "three sisters": Moody's S&P, and Fitch. The publications and ratings of these three agencies therefore have a significant impact on the economy of a specific country.

Conventional credit ratings are calculated based on a mix of economic, political and financial risks – mainly current risks. However, current risks – like GDP – do not reflect the Framework that creates the current situation. Current risks integrate the wider environment – the ability and motivation of the workforce, the health of the population and natural environment (natural capital and man-made) that have caused the current situation. It is therefore questionable whether credit ratings truly reflect investment risks of investing in a specific country.

For a detailed analysis, download the ESG Sovereign Bond Report.

Conventional vs. Comprehensive Rating Frameworks

Traditional Credit Rating Factors

Comprehensive ESG Framework (GSCI)

Key Difference: Traditional credit ratings focus on 4 narrow financial and economic factors, while the GSCI evaluates 6 comprehensive capital dimensions with 239 quantitative indicators, providing a complete picture of sustainable competitiveness.

Why ESG-Adjusted Ratings Matter

Overvalued Countries

Resource-dependent economies, particularly oil exporters in the Middle East, receive higher conventional ratings that don't account for long-term sustainability risks and transition vulnerabilities.

Undervalued Countries

Emerging markets with strong environmental governance, social cohesion, and institutional quality often receive lower ratings due to GDP-centric methodologies.

Systemic Bias

Traditional ratings correlate heavily with GDP/capita, systematically rating poorer countries lower and charging them higher interest rates—creating a vicious credit trap.

Comprehensive Sovereign Ratings Analysis

Our ESG-adjusted ratings provide a more complete picture of sovereign risk, integrating environmental, social, and governance factors that traditional ratings overlook.

Read Full AnalysisProfessional ESG Risk Management Dashboard

Access interactive ESG country risk data and analytics for 192 countries with real-time insights and custom reports.

Find out moreESG credit ratings vs. conventional sovereign bond ratings

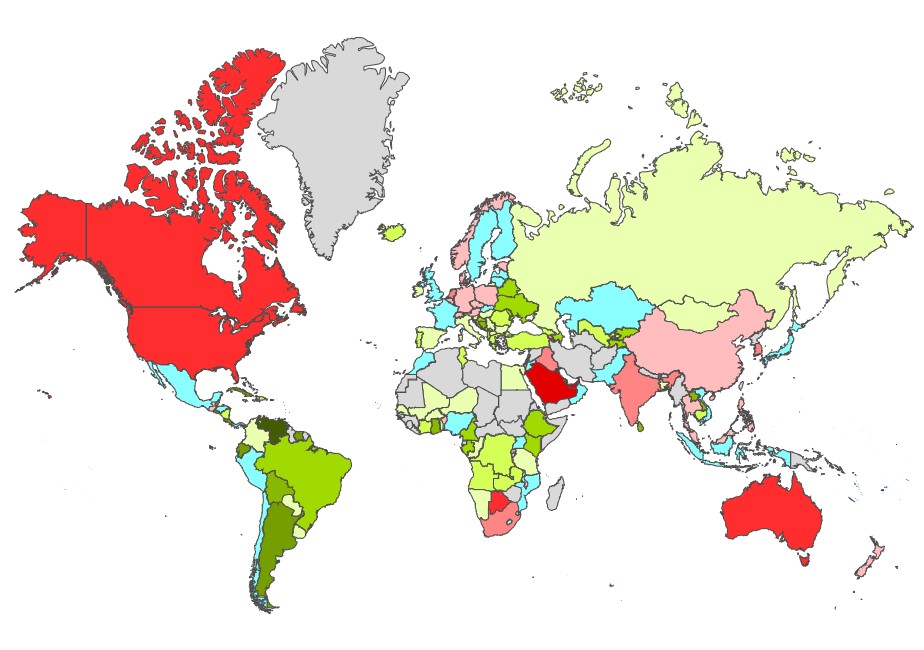

To compare currently used sovereign bond ratings, an ESG-adjusted credit rating has been computed based on the Global Sustainable Competitiveness (GSCI). The GSCI covers all themes insufficiently integrated in conventional credit ratings. The comparison between ESG and current ratings shows significant differences: Northern European (Scandinavia), Japan, the Middle East, the USA, but also China and India all would be downgraded while a number of lesser developed nations in South America, Eastern Europe and Africa would receive better credit rating. For more detailed information, download the ESG Sovereign Bond Rating Report.

ESG Ratings vs currently used country credit ratings:

Download the Full ESG Sovereign Bond Report

Get comprehensive ESG credit ratings and analysis for 192 countries

View Downloads