The Gulf countries have the resources and capabilities to thrive without oil income. However, the rapid transition to renewable energy requires urgent action to diversify economies before fossil revenues collapse.

The Challenge: Dependency on Fossil Fuels

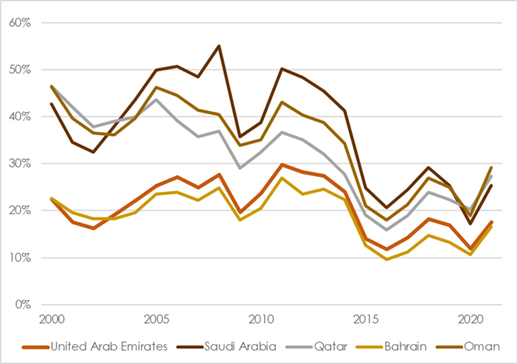

Gulf Cooperation Council (GCC) countries—Saudi Arabia, the United Arab Emirates, Qatar, and Kuwait—currently generate between 15% and 40% of their GDP from oil and gas exploitation. Even more critically, fossil fuels account for close to 100% of government revenues in most of these nations. This extreme dependency creates vulnerability as global energy markets undergo fundamental transformation.

Fossil rent of Gulf area countries as % of GDP (Source: World Bank)

Oil GDP Gulf Countries (Source: World Bank)

Key Facts About Gulf Oil Dependency

- Gulf countries generate 15-40% of GDP from fossil fuel exploitation

- Government revenues depend nearly 100% on oil and gas exports

- Renewables and electric technologies are now much cheaper than fossil alternatives

- Global oil demand will peak between 2025-2027, then decline

- Fossil revenues are set to drastically decline after 2030

The Economic Reality: Renewables Are Now Cheaper

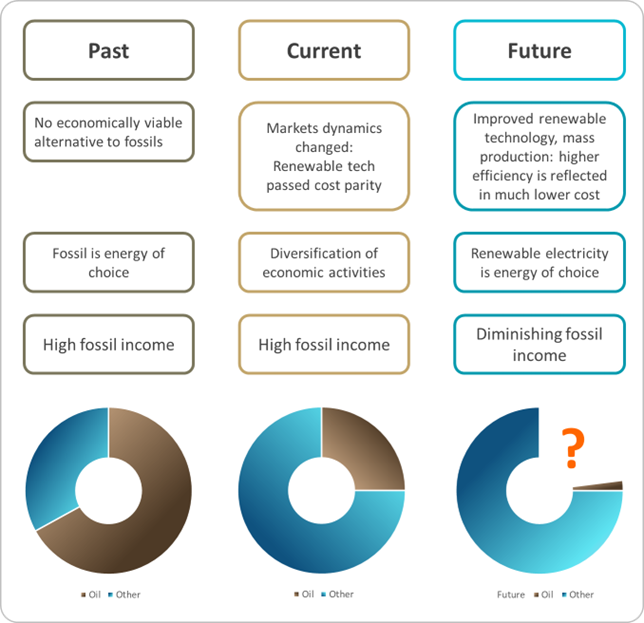

The markets for renewables and electricity-powered consumption have reached unstoppable momentum. It's simple economics: renewables are—by a large margin—more efficient and cheaper than fossil alternatives. Solar and wind electricity now cost 40% of the cheapest fossil generation. Electric vehicles operate at a fraction of the cost of gasoline vehicles. Heat pumps provide heating more efficiently than fossil-fired systems.

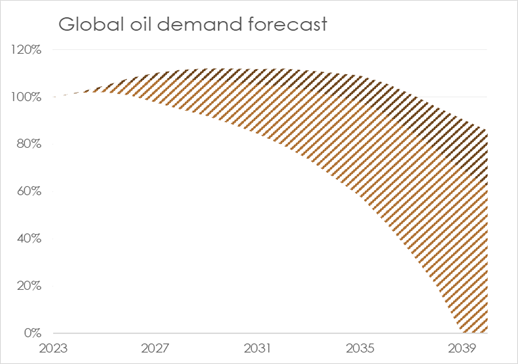

As a consequence, fossils and fossil-powered consumption are no longer competitive. Demand for oil will peak between 2025 and 2027, then start to decline—slowly at first, accelerating over time. Demand, revenues, and profits from fossils will decline accordingly. This is not a matter of environmental policy alone; it is driven by economic fundamentals that make renewable energy the rational choice.

The Timeline: Faster Than Expected

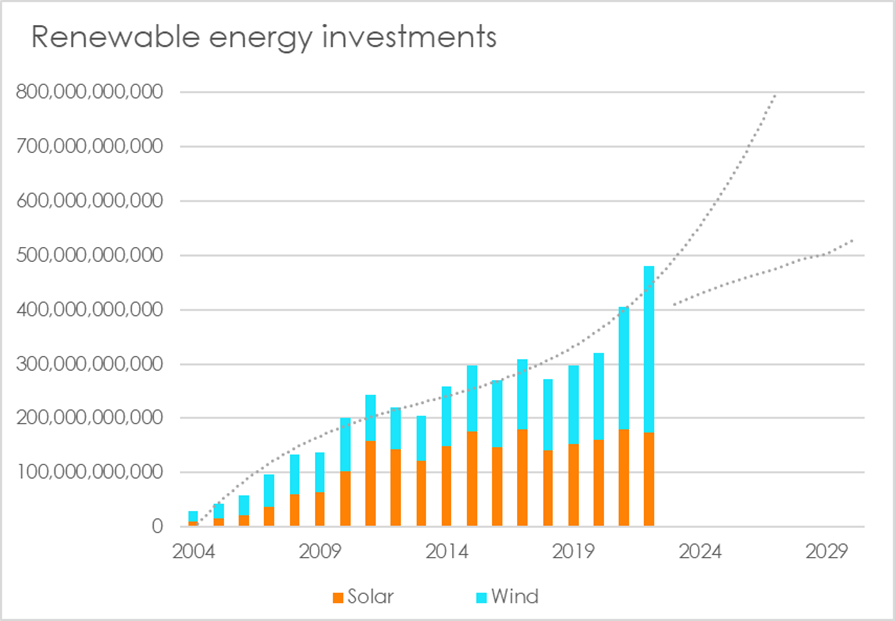

Fossil income in Gulf countries is set to drastically decline after 2030 at the latest, and might well be close to zero by 2040. This timeline is accelerating faster than most projections anticipated. Past forecasts consistently underestimated the pace of renewable deployment and the power of market forces driving the energy transition.

Development of renewable investments (Source: IRENA, IEA)

Future oil demand (Source: IEA, BP, SolAbility)

The energy transition will happen faster than the "mainstream" currently expects

Market dynamics, technological improvements, and declining costs create reinforcing cycles that accelerate renewable adoption. Gulf countries must revise their development visions and investment plans to match this accelerated timeline.

Current Diversification Efforts: Progress Varies

Gulf countries have begun diversification efforts with varying degrees of success. These efforts have focused on developing alternative income streams including hub functions, service centers, tourism, and hospitality. However, progress differs significantly across the region.

United Arab Emirates: Leading Diversification

The UAE has made the most progress in reducing fossil dependency. Dubai has successfully positioned itself as a global business, tourism, and logistics hub. Abu Dhabi has invested heavily in renewable energy, technology, and cultural sectors. The UAE's governance capacity and strategic planning have enabled relatively rapid economic diversification compared to regional peers.

Qatar: Advanced but Still Dependent

Qatar has leveraged its natural gas wealth to build infrastructure and position itself as a regional hub. Major investments in education, healthcare, and aviation demonstrate commitment to diversification. However, the economy remains heavily dependent on gas exports, requiring accelerated transition efforts.

Saudi Arabia: Vision 2030 in Progress

Saudi Arabia's Vision 2030 represents an ambitious diversification plan. Investments in tourism, entertainment, technology, and renewable energy signal recognition of the need to transition. However, implementation faces challenges, and the pace must accelerate to match the speed of global energy transition. The kingdom's size and population create both opportunities and complexities in managing transformation.

Kuwait: Early Stages of Diversification

Kuwait has made less progress in reducing fossil dependency compared to its neighbors. Political challenges and governance constraints have slowed diversification efforts. Urgent action is needed to develop alternative economic sectors before oil revenues decline significantly.

Advantages: Resources for Successful Transition

Despite challenges, GCC countries possess significant advantages that position them to successfully manage the transition away from fossil dependency:

Key Advantages for Transition:

- Financial Resources: Sovereign wealth funds provide capital to finance economic transformation and cushion transition costs

- Infrastructure Investments: Past investments in world-class infrastructure create foundations for diversified economies

- Education and Healthcare: Investments in education systems and healthcare build human capital necessary for advanced economies

- Strategic Location: Position as a bridge between Asia, Europe, and Africa enables hub functions in logistics, finance, and services

- Renewable Energy Potential: Abundant solar resources position Gulf countries to become renewable energy exporters through green hydrogen and electricity

- Existing Business Ecosystems: Developed business centers in Dubai, Doha, and increasingly Riyadh attract international companies and talent

Thanks to these financial resources and past investments in infrastructure, education, and health, GCC countries are in a reasonable position to successfully transition to advanced economies without fossil income—if they act decisively and allocate resources wisely.

The Path Forward: Accelerated Action Required

Current circumstances and the accelerating pace of energy transition require intensified diversification efforts. The window for managed transition is narrowing. Delay increases the risk of economic crisis as fossil revenues decline faster than alternative income streams develop.

Priority Investment Areas

Resources and investments must be allocated wisely in areas that promise the highest return on investment in terms of sustainable competitiveness:

- Renewable Energy Leadership: Leverage solar advantages to become exporters of green hydrogen and renewable electricity, positioning for the post-fossil energy economy

- Advanced Manufacturing: Develop high-value manufacturing sectors in renewable energy equipment, electric vehicles, and advanced materials

- Technology and Innovation: Build innovation ecosystems in artificial intelligence, biotechnology, and clean technology

- Education Excellence: Transform education systems to world-class standards, creating human capital for knowledge economies

- Financial Services: Develop Islamic finance and sustainable finance centers serving regional and global markets

- Tourism and Culture: Build sustainable tourism sectors that showcase cultural heritage while creating employment

- Healthcare and Wellness: Position as regional healthcare excellence centers, combining medical tourism with research

- Logistics and Trade: Strengthen positions as global logistics hubs connecting continents

Governance and Institutional Reforms

Economic diversification requires parallel improvements in governance systems. Effective institutions, transparent regulations, and accountable administration become increasingly important as economies diversify beyond resource extraction. Countries must:

- Strengthen rule of law and regulatory frameworks for diverse economic sectors

- Improve transparency and accountability in public administration

- Develop competitive business environments that attract international investment

- Build social cohesion and inclusive development that shares transition benefits broadly

- Create labor market flexibility while protecting worker rights

Regional Cooperation

GCC countries can accelerate transition through enhanced cooperation. Coordinated approaches to renewable energy development, education standards, research collaboration, and market integration create efficiencies and strengthen regional competitiveness. Competition between Gulf states should focus on excellence rather than duplication, with each country developing specialized strengths within an integrated regional economy.

The Stakes: Prosperity or Decline

The choices Gulf countries make in the next few years will determine whether they successfully transition to prosperous, diversified economies or face declining living standards as fossil revenues evaporate. The advantages are real: financial resources, infrastructure, strategic location, and renewable energy potential. However, advantages mean nothing without decisive action.

The pace of global energy transition is accelerating. Countries that delay—hoping for oil demand recovery or gradual transition—will face crisis as revenues collapse faster than new economic sectors develop. Those that act decisively now, allocating resources to highest-return investments in sustainable competitiveness, can build prosperous post-oil economies.

Gulf countries have everything needed to succeed in the post-fossil economy—except time

The window for managed transition is closing. Urgent, accelerated action on economic diversification is not optional—it is essential for maintaining prosperity and avoiding economic crisis.

Conclusion: The Transition Is Inevitable and Urgent

The energy transition represents an existential challenge for Gulf economies. However, it also creates opportunities to build more sustainable, diversified, and resilient economic systems. The resources exist to succeed. The question is whether political will and institutional capacity match the urgency of the challenge.

Gulf countries must accelerate current diversification efforts, invest strategically in areas promising highest returns, strengthen governance and institutions, and cooperate regionally. The alternative—continued dependency on declining fossil revenues—leads to economic crisis and declining living standards. The choice is clear. The time to act is now.

Learn More

For analysis of how energy transition affects national competitiveness, explore the Global Sustainable Competitiveness Index or read about why fossil fuels are no longer competitive.